montana sales tax rate 2021

1000000 Salary Calculation with Graph. 2500000 Salary Calculation with Graph.

74 would impose a 4 sales and use tax on the sale of tangible personal property in the State of Montana and authorize the Department of Revenue to enter into the.

. Alcohol Tax Incentive Biodiesel Tax Information Contractors Distributor Reporting Distributor Licensing Bonding General Fuel Tax Questions Fuel Tax Laws and Fuel Tax Legislation 406-444-0806 Email. 3000000 Salary Calculation with Graph. In effect that lowers the top capital gains tax rate in Montana from 69 to 49.

For Appeals please call. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800. Look up 2022 sales tax rates for Sula Montana and surrounding areas.

1 A sales tax of the following percentages is imposed on sales of the following property or services. Dyed Fuel Toll-free Tip Line 1-888-383-5529 Email. Montana does not impose a state-wide sales tax.

500000 Salary Calculation with Graph. Unlike many other states there is no sales tax in Montana. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average.

Montana charges no sales tax on purchases made in the state. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. MT Tax Calculations Click to view a salary illustration and print as required.

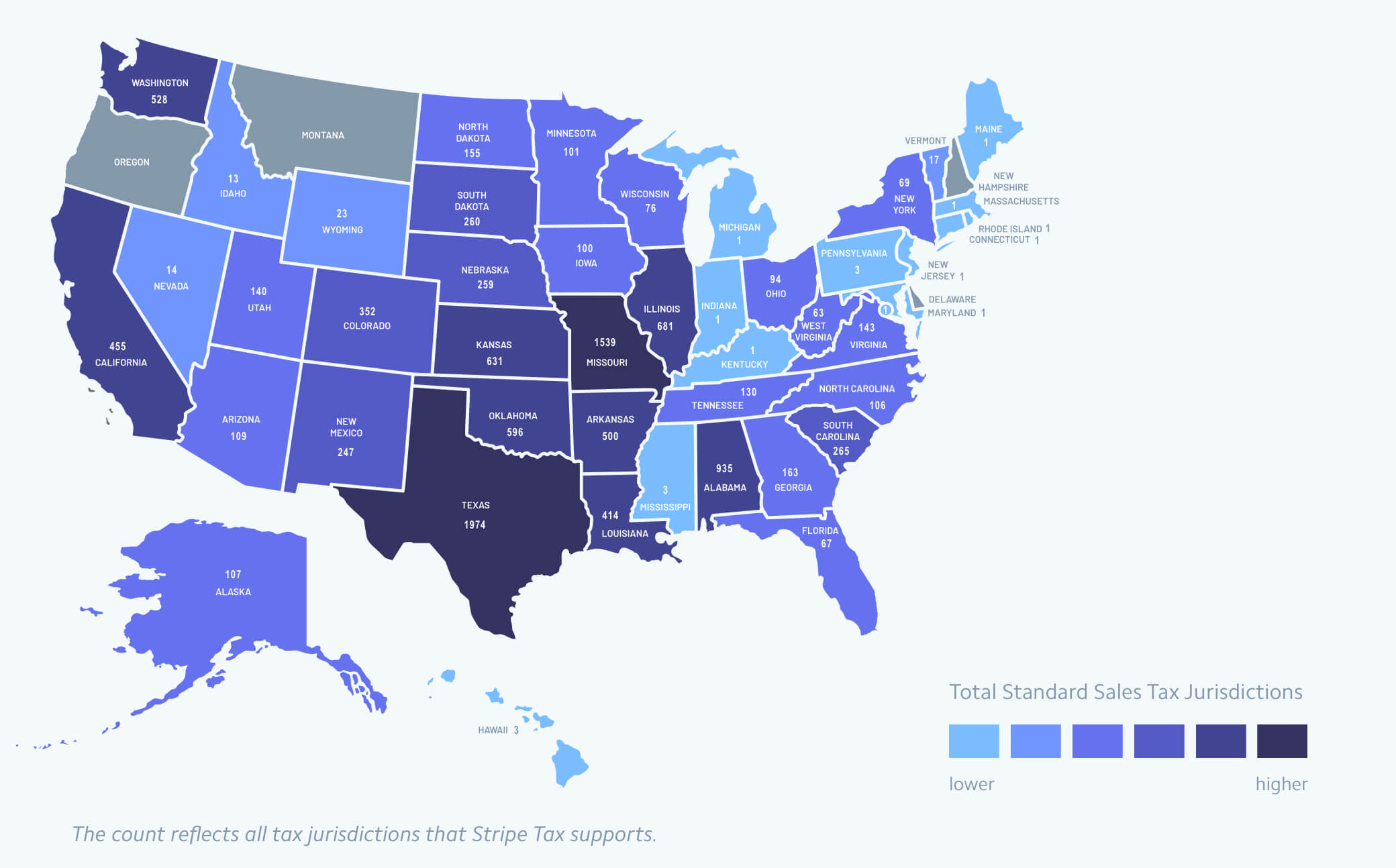

The bill did not affect the six lowest. 2021 Local Sales Tax Rates The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 510 percent Colorado 482 percent New York. Montana Fuel Tax Information.

B 4 on the base rental charge. The minimum combined 2021 sales tax rate for Sheridan Montana is. There are no local taxes beyond the state rate.

Tax rates are provided by Avalara and updated monthly. Montanas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Montanas. Look up 2022 sales tax rates for Malta Montana and surrounding areas.

Local Tax Rate a Combined Rate Rank Max Local Tax Rate Ala. Tax rates are provided by Avalara and updated monthly. Although the lowest rate rises to 47 percent up from 10 percent conforming to the federal standard deduction 12400 last year compared to Montanas current standard deduction of 4790 yields tax savings for low-income taxpayers as well.

A 4 on accommodations and campgrounds. Montana currently has seven marginal tax rates. 400 40 522 922 5 750.

However the act imposed limitations on the states use of the funds. The state sales tax rate in Montana is 0000. You can learn more about how the Montana income tax compares.

Goods and services can be. If enacted Draft Bill LC. Tax Rate Starting Price Price Increment Montana Sales.

Montana received about 930 million in ARPA funds. There is also no local sales tax imposed in specific counties so all purchases made in the. While graduated income tax rates and brackets can be complicated and.

There is no state sales tax in Montana. Sales Tax Rates by State One of the more transparent ways to collect tax income is through retail sales taxes. 2022 Montana Sales Tax Table.

Montana Sales Tax. It specifically prohibits a state from using the funds to offset a. State Local Sales Tax Rates as of January 1 2021 State State Tax Rate Rank Avg.

2000000 Salary Calculation with Graph. 1500000 Salary Calculation with Graph.

How To Charge Sales Tax In The Us 2022

Everything You Need To Know About Shopify Taxes Full Guide Quickly Learn Everything You Need To Know

Introduction To Us Sales Tax And Economic Nexus

State Corporate Income Tax Rates And Brackets Tax Foundation

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

State Income Tax Rates Highest Lowest 2021 Changes

Sales Tax Definition What Is A Sales Tax Tax Edu

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Charge Sales Tax In The Us 2022

U S Sales Taxes By State 2020 U S Tax Vatglobal

State Corporate Income Tax Rates And Brackets Tax Foundation

Is Buying A Car Tax Deductible Lendingtree

Arizona Sales Tax Small Business Guide Truic

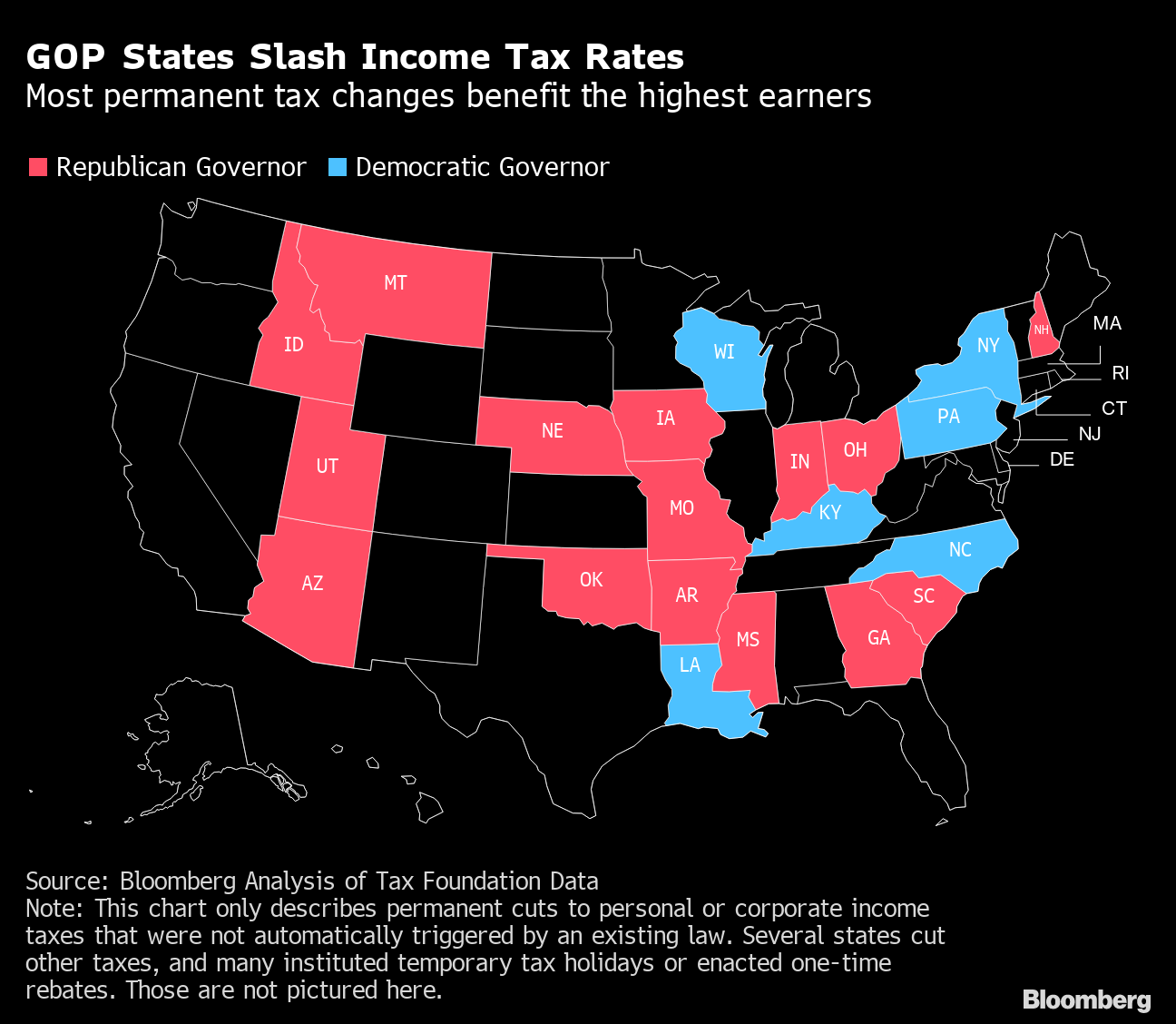

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

States With The Highest And Lowest And No Sales Tax Rates States With Lowest Local Sales Tax Youtube